01

Business needs

A Fortune 500 payment card company wanted to create a unified platform to overcome silos and centralize data from multiple systems, making it consumable for business use case development. The company was looking for a solution that could:

- Collect and process large volumes of data generated from disparate sources

- Overcome data silos and related security risks by creating a single source of truth

- Improve data accessibility and shareability across different systems

- Generate analytical insights from the collected data to unlock specific business use cases

- Overcome challenges with data integrity and data localization while meeting security compliances

02

Technical needs

The payment card company wanted its on-prem unified data platform to have the following capabilities:

- Store petabytes of data without system downtime

- Manage end-to-end security for data and access management via a simplified and effective solution

- Provide dedicated support for data backup and disaster recovery

- Simplify complex processes for managing security, governance, compliances, and auditing

Furthermore, the payment card company wanted to develop a data ingestion framework to:

- Manage multiple file formats

- Register and review metadata

- Perform generic data validation and quality check

- Improve reusability by using common components

- Simplify the onboarding of new feeds

Brought $36+ million revenue benefit with improved risk and fraud detection features and significant reduction in false positive cases

03

Solution

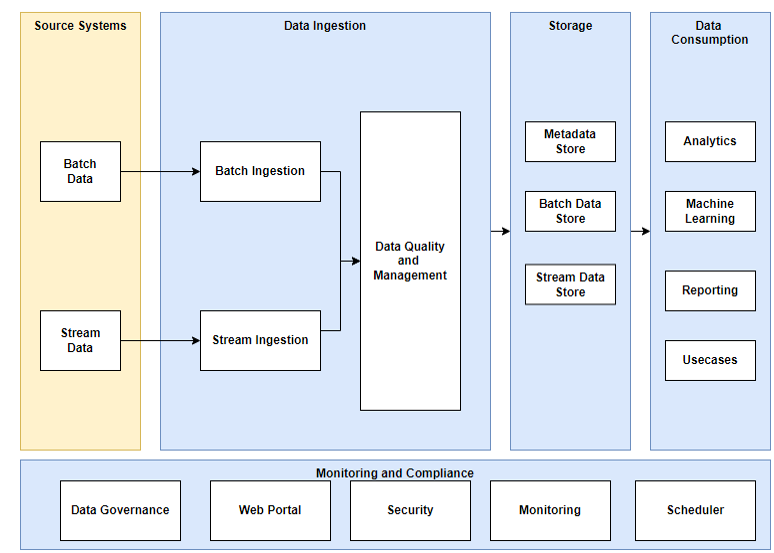

The Impetus team strategically evaluated the requirements of the payment card company to create an on-prem unified data platform with the following highlights:

- Automated the ingestion framework to support batch and real-time ingestion of data from several internal and external data sources

- Developed a common utility to secure data and simplified the process of onboarding new feeds to the system

- Unified over 30PB of data and 8000+ feeds from disparate sources, creating a single source of truth

- Built a common metadata repository for large volumes of data available in the data lake

- Created a centralized web-based portal to manage numerous capabilities such as metadata management, data governance, onboarding, and more

- Addressed all compliance requirements by creating secure data centers and simplifying processes to manage end-to-end security for data and access management

- Defined the overall access management flow by creating different levels for access roles

- Served the real-time requirements of customers with a low-latency cache solution

The architecture diagram of the implemented solution is given below:

Fig 1: Architecture overview of the solution

Generated $80 million daily revenue and increased the offer acceptance rate by 300% by leveraging advanced analytics to provide a personalized marketing experience

04

Impact

A unified data platform provided a single source of truth to the payment card company and enabled the firm to:

- Unlock 500+ use cases by leveraging the AI/ML and analytics capabilities of the modern solution

- Bring $36+ million revenue benefit by advancing risk and fraud detection features and significantly reducing false positive cases

- Generate $80 million daily revenue and increase the offer acceptance rate by 300% by leveraging advanced analytics to provide a personalized marketing experience

- Revolutionize the telemarketing experience by providing a topline growth of $3 billion annually and reduce service calls by 7%

- Save time and cost by automatically remediating ~65% of incident failures

- Save storage cost by 60% with the auto archival support for landing zone files

- Ensure zero downtime of the business with the advanced capabilities of the new platform